Printed electronics: the winner is the chemical industry

The chemical industry will end up with most of the added value from printed electronics, one of the fastest growing technologies in the world. Worth over $50 billion to the materials and chemicals industry in 2024, the resultant devices and processes are of vital interest to industries as diverse as consumer goods, healthcare, aerospace, electronics, media and transit - a breadth that reduces business risk, particularly if common formulations can be identified.

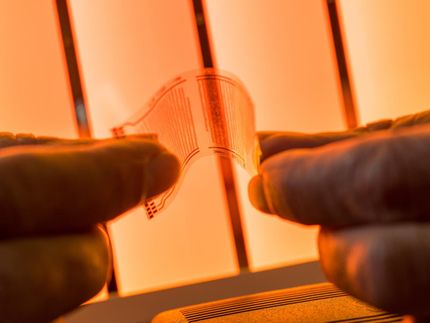

The term "printed electronics" embraces electrics as well as devices that employ thin films likely to be printed or coated with customised fine chemicals in future. It is allowing electronics to be used in places it has never been before because it is variously transparent, stretchable, biodegradable or on and in paper for instance. It is improving existing electronics and electrics.

New report - de-risk your investment in fine chemicals

One new IDTechEx report is specifically designed to address the needs of chemical and materials companies and researchers - Functional Materials for Future Electronics: Metals, Inorganic & Organic Compounds, Graphene, CNT . It is essential for companies entering the new electrical and electronic product space, including printed electronics, to identify the most profitable and widely useful functional compounds and elements needed including allotropes of carbon - this report does that. Morphologies, form factors, derivatives, reasons, trends and niche opportunities are examined so suppliers can de-risk their investment.

Thirty-seven disruptive new device families important to the chemical industry are analysed, from forms of flexible photovoltaics to fuel cells, artificial muscle, memristors, metamaterials, new forms of lithium battery and nano- electromechanical systems NEMS. The report determines the most important elements and compounds needed for them and the electrical functions that they perform, plus future trends and commonalities between formulations. Several of the world's largest chemical companies asked for this.

For example, the widest future use of fine inorganic and organic compounds and carbon allotropes in the new electrics and electronics is, in order of breadth of application:

- 1: Copper

- 2: Aluminium

- 3: Silver

- 4: Polyethylenes

- 5: Carbon nanotubes

- 6: Graphene

- 7: Indium compounds, Titanium compounds and Fluoropolymers

- 8: Silicon compounds

- 9: Zinc compounds, Polythiophenes

On the other hand, those materials that are most versatile in electronic and electrical functions and therefore potentially providing widespread, high added value are identified as titanium compounds, zinc compounds and fluoropolymers. Thirdly IDTechEx identifies those that will be sold in the largest gross value over the next ten years, a category that includes those that are lithium and gallium compounds. The report profiles 113 global organizations involved in carbon allotropes for the new electronics and electrics. While manufacturers in North America seem to focus more on SWCNTs; Asia and Europe, with Japan on top, are leading the production of MWCNTs with Showa Denko, Mitsui and Hodogaya Chemical being the largest companies.

The new electronics and electrics spans nano- to very large devices. For example, one of the key enabling technologies - printed electronics - gives us viable electronic billboard sheets and huge areas of unrolled photovoltaics, soon in stretchable and conformal form. There are new device principles and chemistries. Whether it is totally new forms of flat screen displays or re-invented lithium-ion batteries with completely different anode, cathode and electrolyte compounds, those at the start of the value chain tend to make higher margins than those making the devices themselves.

Of course it is arbitrary whether some devices are really new because some are very old inventions in new forms or they have been in the wilderness for decades but are now ready for prime time. Others are experiments that may fail technically or in the marketplace. Others could choose a somewhat different choice of "new" device families but IDTechEx believes that they would reach much the same conclusions concerning the league table of substances required.

Key elements and compounds for the next ten years

IDTechEx finds that the metals that will be most widely used over the coming decade are aluminium, copper and silver, notably for conductive patterning in interconnects, electrodes, antennas and actuators. The inorganic elemental semiconductor most in demand in the new electronics will be silicon. Mainly, it takes new forms such as ink. The numerous functions of fine chemicals in the new electronics and electrics are annotated in the report; including adhesive, active electrode, active substrate, binder, barrier layer, electroactive material or dielectric elastomer, electrochemical membrane, electrolyte, electret, ferroelectric memory and many more.

Of the opportunities for inorganic compounds, IDTechEx discovers that lithium salts for lithium-ion batteries are particularly complex, changing in formulation and morphology and growing in large demand. IDTechEx therefore give a further analysis of this opportunity. In the report, there is comparison of 138 lithium-based rechargeable battery manufacturers and the 15 key compounds and elements they use and develop, with cathode and anode chemistry, electrolyte morphology, cell format and form of materials used.