The Carlyle Group to Buy DuPont Performance Coatings Business for $4.9 Billion

Advertisement

Global alternative asset manager The Carlyle Group and DuPont announced that they have signed a definitive agreement whereby Carlyle will purchase DuPont Performance coatings (DPC) for $4.9 billion in cash. The transaction is expected to close in the first quarter 2013, subject to customary closing conditions and regulatory approvals.

DPC is a global supplier of vehicle and industrial coating systems with 2012 expected sales of more than $4 billion and more than 11,000 employees. The investment will be funded with equity from Carlyle Partners V and Carlyle Europe Partners III.

Greg Ledford, Carlyle Managing Director and Head of the Industrial and Transportation team, said, “DuPont Performance Coatings is a successful business with attractive market positions, next-generation technology and established brands. Through targeted investments we will support DPC’s product development and growth objectives as it transitions to a stand-alone company. We look forward to working with management to fully realize DPC’s great potential.”

Most read news

Other news from the department business & finance

These products might interest you

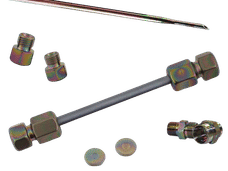

Dursan by SilcoTek

Innovative coating revolutionizes LC analysis

Stainless steel components with the performance of PEEK - inert, robust and cost-effective

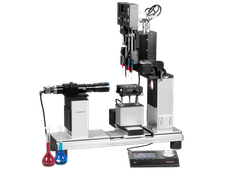

OCA 200 by DataPhysics

Using contact angle meter to comprehensively characterise wetting behaviour, solids, and liquids

With its intuitive software and as a modular system, the OCA 200 answers to all customers’ needs

Tailor-made products for specific applications by IPC Process Center

Granulates and pellets - we develop and manufacture the perfect solution for you

Agglomeration of powders, pelletising of powders and fluids, coating with melts and polymers

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.