Merck Reaches Agreement on Recommended Cash Offer for AZ Electronic Materials

Merck announced an agreement with the Board of Directors of AZ Electronic Materials (AZ) regarding a recommended cash offer for the entire share capital of AZ to further expand Merck’s materials and specialty chemicals business by adding a globally leading premium supplier of high-tech materials for the electronics industry.

According to the terms of the agreement, Merck is offering GBpence 403.5 per share of AZ in cash, valuing AZ at around GBP 1.6 billion (around € 1.9 billion). The offer represents a premium of around 41% over the 3-month volume-weighted average share price of AZ. The Board of Directors of AZ intends to recommend that the company’s shareholders accept the offer and the directors have irrevocably undertaken to tender their own shares (representing approximately 0.7% of the issued share capital of AZ). The acquisition will be 100 percent financed by existing cash resources. The successful completion of the transaction is among others conditional upon antitrust clearance as well as a minimum acceptance level of 95% of the share capital.

“With this strategic move we are strengthening the portfolio of Merck by adding a premium business to our existing business of high-margin specialty chemicals,” said Karl-Ludwig Kley, Chairman of the Executive Board of Merck. “The combination will enable Merck to access additional growth areas in the electronics industry to benefit even better from the increasing demand for electronic devices beyond displays. The proposed offer also marks another milestone in our transformation journey toward a highly specialized technology company offering tailor-made solutions to patients and customers.”

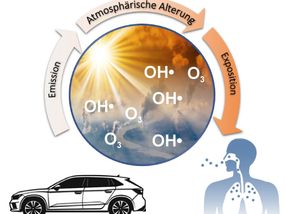

With its high-quality, high-purity specialty chemical materials for the electronics industry, AZ in 2012 generated revenues of US$ 794 million (€ 584 million) and operating profit (EBITDA) of US$ 262 million (€ 193 million). The IC Materials division, which produces process chemicals for the production of integrated circuits used in electronic devices such as computers, smart phones, mp3 players and games consoles, accounted for around 70% of last year’s revenue. The divisional EBITDA margin was around 41% in 2012. The Optronics division, which produces light-sensitive materials, also known as photoresists, for the production of flat panel screens as well as silicon-chemistry based products for optoelectronics, accounted for around 30% of last year’s revenue, with an EBITDA margin of around 29%. AZ had around 1,100 employees at the end of 2012, with almost 60% of these located in Asia.

Merck expects that the combination of two outstanding research and development teams will lead to new innovative solutions for customers in the electronics industry. By combining different competencies, Merck in the future will be in an even stronger position to serve the demand for materials with increasingly complex functionalities. Merck expects the transaction to generate annualized synergies of € 25 million by 2016 through the rationalization of overlapping corporate and administrative functions. Integration costs related to the transaction are estimated at approximately € 50 million, spread over the years 2014 to 2016. The transaction will be immediately accretive to EPS pre (earnings per share pre one-time items and amortization from purchase price allocation), based on 2012 pro-forma figures.

Most read news

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.