Akzo Nobel earnings slightly below last year’s record second quarter

Strong performance for Pharma, major restructuring at Coatings and Chemicals

Advertisement

Akzo Nobel (EURONEXT: AKZ: NASDAQ: AKZOY), the international pharmaceuticals, coatings and chemicals company, achieved second-quarter net income* of EUR 256 million (USD 223 million; GBP 155 million), slightly below last year’s record EUR 265 million. The Company also booked a net loss for extraordinary and nonrecurring items of EUR 175 million. restructuring plans in Akzo Nobel’s Coatings and Chemicals businesses will impact 2,000 jobs at 30 sites worldwide. Fritz Fröhlich, Akzo Nobel’s CFO: “We had acceptable results, especially considering the fact that the comparative quarter last year was our all-time high. Pharma continued its outstanding performance, but Coatings and Chemicals are under pressure and need major changes to structurally reduce cost levels. They are accelerating their restructuring programs, involving headcount reductions and rationalization of production sites.” Akzo Nobel’s outlook for the full year remains unchanged. The Company expects to deliver results* in the same order of magnitude as in 2000, its best year ever.

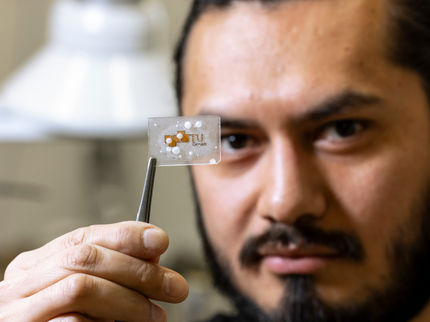

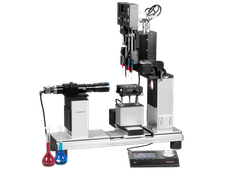

Total sales of the Company in the second quarter were up 4% to EUR 3.7 billion, mainly driven by a 14% increase in the ongoing Pharma business. Organon (human healthcare) is maintaining double-digit growth and Intervet (animal healthcare) achieved strong earnings improvement, the result of its successful integration of new businesses. “Organon and Intervet keep delivering strong growth. The future looks good due to our strong pipeline,” Fröhlich said. “We filed our anti-depressant ArizaTM with the FDA and are expecting fast approval for our new antithrombotic Arixtra®, both scheduled for launch in the United States. The consolidation benefits in animal healthcare, where we hold a leading position, have begun to flow through, and Intervet is achieving higher margins, on a level comparable to other attractive pharma businesses.” Diosynth, which produces complex active ingredients for the pharmaceutical industry, has acquired Covance Biotechnology Services, providing a biotech bridgehead into the United States and substantially enhancing its prospects in this important market. Fröhlich: “Lastly, in line with our commitment to find a critical mass solution for Organon Teknika’s diagnostics business, we transferred these activities to bioMérieux, for EUR 311 million, on a cash and debt free basis.”

About Coatings, Fröhlich continued, “Our Coatings business has to deal with continued pressure on results, requiring restructuring programs to bring earnings to acceptable levels. We are the No. 1 coatings manufacturer in the world and our goal is to deliver industry-leading efficiency and financial performance as well. Markets for decorative and industrial coatings have been impacted by rising costs, while sales have suffered from the depressed economic climate. We see raw material prices starting to come down slowly, but we are also planning action ourselves. This involves a reduction of the Coatings workforce by some 1,000 jobs, mainly in Europe. These measures are expected to increase efficiency and bring profit margins to healthier levels.”

In Chemicals, margins are also under pressure. Fröhlich said: ”Akzo Nobel’s Chemicals businesses are showing a mixed performance. In Base Chemicals we had a scheduled maintenance shutdown at two major sites, impacting sales volumes. As a whole, the Chemicals sector is clearly being hit by the economic slowdown and also suffering from high raw material and energy prices. Performance in the United States continues to be weak, while Europe is seeing steep declines. In Chemicals, we are also expanding and accelerating our restructuring programs to improve the cost structure and margins. This will affect another 1,000 jobs.”