Product Innovation Holds the Key to Faster Growth for Plastics in Automotive Applications

06-Sep-2001

Resin suppliers, together with OEMs and processors, must continue to

introduce innovative products and technologies to further drive the

development of new applications for engineering plastics in the automotive

market, according to a new study from Frost and Sullivan. Developing

technologies that are credible alternatives to traditional materials such

as metal and glass can be expected to open up new market opportunities.

David Platt, Senior Plastics Industry Analyst at Frost & Sullivan explains;

"lower growth is predicted for engineering plastics in the automotive

industry during the period 2001-2007 because of the downturn in European

car production and also due to the growing market maturity for plastics in

a number of important automotive applications. Car producers will however

continue to strive for lower costs, weight reduction and fuel economy,

while at the same time introducing more comfort and safety features into

their products. These requirements, combined with technological

innovation, will drive the development of new applications for engineering

plastics in passenger cars."

There are many examples of how new technologies are being developed to

create opportunities for plastics in the automotive market. Some of the

most notable are:

· GE Plastics Noryl products based on blends of polyphenylene oxide have

the advantages of better heat resistance and conductivity, which has led to

their replacement of other polymers in bumper systems. Noryl's better heat

resistance and lower odor emissions also gives it an advantage over PC/ABS

for car instrument panels.

· Bayer's "hybrid technology", binding plastics and steel, which lowers

weight and module costs and creates a high load-bearing capacity while

allowing high energy absorption has led to its use in components for doors,

seats, front ends and bumper brackets.

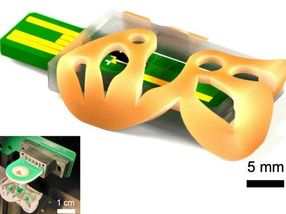

· Exatec's automotive glazing systems based on polycarbonate are thought

to give a weight saving of around 40% compared with glass. Product and

systems development is focussed on the rear and side windows, which should

be ready for market testing in 2002.

In 2000, the total tonnage of engineering plastic used in passenger cars

was 1.4 million tonnes, the study forecasts that in 2007 this will have

risen to 1.7million tonnes ? representing a 2.6 % compound annual growth

rate. This is significantly lower than the previous 4 years when unit rate

growth averaged nearly 6% per annum. Use of plastics in electrical and

lighting systems and under the bonnet applications will show the fastest

growth rates, whilst the market shares for both interior and exterior

plastics will decline.

polypropylene is by far the most commonly used resin and is found mainly

inside the car for instrument and door panels. However, over the forecast

period it is expected to lose market share to other polymers such as PC/ABS

blends.

This new study is an in-depth analysis of trends in the use of all types of

engineering plastics, throughout the range of automotive application areas.

It gives an insight into the competitive structure of the market and makes

strategic recommendations for future success in this market.

Sales Contact

European Engineering Plastics in Automotive Applications (report code

3872-39) published September 2001 is available to purchase from: Frost &

Sullivan, 4100 Chancellor Court, Oxford Business Park, Oxford, OX4 2GX, UK.

Sales Contact: Bill Stringer +44 (0) 1865 398651,

bill.stringer@fs-europe.com

Most read news

Topics

plastics

glass

Frost & Sullivan

GE - Plastics

Exatec

Bayer

Replacement

reductions

polypropylene

emissions

conductivity

absorption

Organizations

Frost & Sullivan

Other news from the department business & finance

Get the chemical industry in your inbox

From now on, don't miss a thing: Our newsletter for the chemical industry, analytics, lab technology and process engineering brings you up to date every Tuesday and Thursday. The latest industry news, product highlights and innovations - compact and easy to understand in your inbox. Researched by us so you don't have to.