Bayer signs financing agreement for Aventis CropScience acquisition

Bayer AG today mandated Banc of America Securities Limited, Deutsche Bank AG and J.P. Morgan plc to finance the acquisition of Aventis CropScience. The three banks will provide a credit line of EUR 6 billion as bridge financing, which will also act as backup for the issuance of commercial paper. This will serve to finance the acquisition price for Aventis CropScience.

In the first half of 2002, the bridge facility will be refinanced through the issuance of benchmark bonds, which will be jointly bookmanaged by the aforementioned banks, and the ongoing issuance of commercial paper (CP).

This financing strategy involves a long-term increase in the volume of outstanding commercial paper. In the second quarter of 2002 the three banks will therefore syndicate a backup facility to support ongoing commercial paper issuance.

Bayer had already expanded its existing financing programs in preparation for raising funds in the capital markets. The volume of the global CP program was increased from US$ 5 billion to US$ 8 billion and that of the European Medium Term Note (EMTN) program from EUR 2 billion to EUR 8 billion.

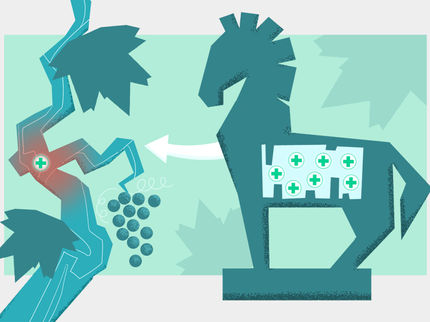

The acquisition of Aventis CropScience will put Bayer close behind the world leader in the agrochemical market. It is planned to combine the crop protection activities of Bayer and Aventis CropScience into a new company named Bayer CropScience, which will target EUR 8.1 billion in sales and a 20 percent operating margin for 2005.

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.