The EU Green Deal is a game changer for the process industry, but only very few companies know the rules of the game.

BearingPoint - Chemical, Pharmaceutical, Oil & Gas Industry Sentiment Barometer on the EU Green Deal

Advertisement

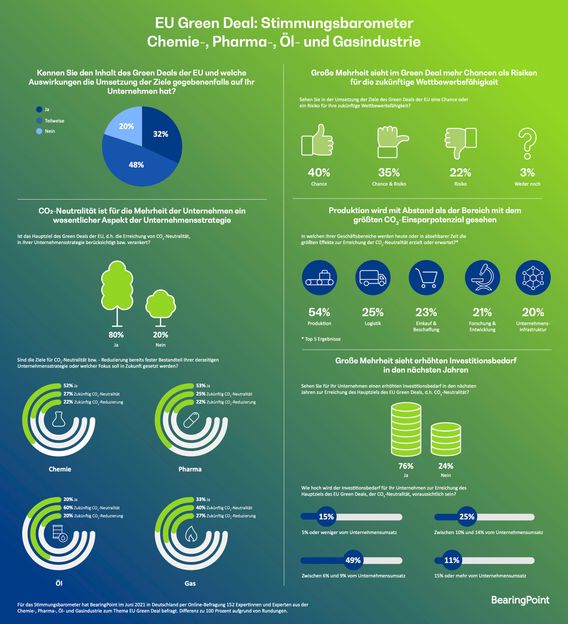

Many companies in the chemical, pharmaceutical, oil and gas industries see more opportunities than risks for their own future competitiveness in the European Union's Green Deal. However, only one third of the companies are even aware of the exact objectives of the Green Deal and quite a few are still in the dark here, as the sentiment barometer of the management and technology consultancy BearingPoint shows.

Infographic "EU Green Deal:Sentiment Barometer Chemical, Pharmaceutical, Oil and Gas Industries".

BearingPoint

While a third of the companies surveyed are well aware of the Green Deal, for 48 percent the contents are only partially clear. And a full 20 percent say they are not at all familiar with the EU Commission's plans.

Large majority sees more opportunities than risks for future competitiveness in the Green Deal

Those respondents who are familiar with the contents of the EU's Green Deal see the implementation of these goals as an opportunity (40 percent) for future competitiveness, for example through the definition of new or adapted business models that meet the requirements of the Green Deal. At the same time, 35 percent see both an opportunity and a risk in the implementation of the EU Green Deal objectives. Only 22 percent see it exclusively as a risk.

Jens Raschke, global head of Chemicals, Life Sciences & Resources at BearingPoint, says: "With a view to the EU's Green Deal, companies are well advised to identify opportunities for future competitiveness now, to define and implement suitable measures and to minimise risks. A comprehensive assessment of the Green Deal including scenario analysis provides an important cornerstone in this respect. Particularly with regard toCO2 neutrality or reduction, it is advisable to include these aspects in one's own corporate strategy as early as possible in order to be able to sustainably strengthen the goals forCO2 neutrality and the associated future competitiveness."

CO2 neutrality is a key aspect of corporate strategy for 80 percent of companies

For 80 percent,CO2 neutrality is an essential aspect that should be included in their own corporate strategy. On average, however, only 38 percent have already firmly anchored this in their current corporate strategy. The remaining 42 percent plan to do so in the future, but to varying degrees - either with a focus onCO2 neutrality orCO2 reduction.

Despite the low level of anchoring ofCO2 neutrality in the corporate strategy so far, 60 percent of the participants state that they are strongly influenced in their strategic and operational decision-making processes with regard to achievingCO2 neutrality.

Production is seen by far as the area with the greatestpotential for CO2 savings.

At 54 percent, the respondents rate production as one of the most promising areas for achieving the greatest effects in terms of achievingCO2 neutrality. Logistics is seen as the second most promising area with 25 percent. However, purchasing and procurement, research and development, and corporate infrastructure are also expected to have an impact on achievingCO2 neutrality.

Active management viaCO2 certificates is only named as a suitable measure by 22 percent of the companies surveyed. Just under half currently useCO2 certificates to offset their currentCO2 budget, and over a third have not yet purchased anyCO2 certificates at all (or received them as a gift). According to the survey, the vast majority of the companies surveyed (75 percent) seeCO2 certificates as only a short-term solution on the way to their own climate neutrality.

More than a third of companies do not deal with the issue ofCO2 neutrality

Of the companies surveyed, 36 percent state that they have not (yet) dealt with the issue ofCO2 neutrality or do not see any relevant need for action. In 28 percent of the companies, especially in the chemical and pharmaceutical industries, the topic is already being addressed. Six percent believe that the excessive expense involved in implementingCO2 neutrality does not justify the expected return.

Large majority sees increased need for investment in the next few years

More than two thirds of the respondents (75 percent) see an increased need for investment in the next few years to achieveCO2 neutrality. Of these two-thirds, the majority (49 percent) see investment requirements of between six and nine percent of their own company turnover. In general, larger and medium-sized companies see a greater need to invest inCO2 neutrality than smaller companies. The majority of respondents (69 percent) consider it possible to pass on some of the investment costs for achievingCO2 neutrality to customers.

Jens Raschke: "A quarter of all the companies we surveyed currently rate their own relevance within theCO2 ecosystem as low. However, in our view, this assessment should be urgently reviewed in order to secure their own future competitiveness in the long term. Society, business and politics expect the chemical, pharmaceutical, oil and gas industries in particular to make far-reaching changes to existing processes and business models in order to achieveCO2 neutrality. We recommend that companies review their current business model with regard to future requirements, identify use cases to sustainably strengthen their competitiveness and implement appropriate measures in the relevant areas.

Note: This article has been translated using a computer system without human intervention. LUMITOS offers these automatic translations to present a wider range of current news. Since this article has been translated with automatic translation, it is possible that it contains errors in vocabulary, syntax or grammar. The original article in German can be found here.