Merck on Track to Deliver Sustainable Profitable Growth

Advertisement

Merck expects to achieve sustainable profitable growth in all three business sectors in the coming years. At its Capital Markets Day, the company informed analysts and investors about the progress it has made in implementing its strategy. “In recent years, we have rigorously positioned our businesses in innovation-driven technologies. Science is at the heart of everything we do and the foundation for our future growth,” said Stefan Oschmann, Chairman of the Executive Board and CEO of Merck.

Merck is now in the growth and expansion phase of its strategy and is well on track. In 2016, Oschmann presented the company strategy shortly after taking office as Chairman of the Executive Board. Two years later, Merck defined its “Unite for Growth” strategy through to the year 2022. “We want to become the vibrant science and technology company. This objective is ambitious. With our three innovation-driven business sectors, we are shaping the rapidly advancing technological changes to our world,” said Oschmann.

“For 2019, we continue to assume that the Group will increase all its key figures: sales, EBITDA pre and EPS pre. We also have our sights firmly set on profitable growth for 2020 and beyond,” said Oschmann. Following the expected closing of the Versum Materials acquisition, the company will focus on generating cash in order to quickly lower its post-acquisition debt, as it usually does. In addition, a sustainable culture of cost awareness within the company continues to have high priority.

Healthcare aims to fully leverage the potential of its R&D pipeline

In recent years, Merck has invested heavily in its research pipeline of innovative medicines. By 2022, the company aims to achieve additional annual sales of around € 2 billion with new medicines and is in line with plan. Merck is assuming that the new medicines Mavenclad and Bavencio will contribute significantly to this. The oral MS therapy Mavenclad is currently approved in 69 countries. In May of this year, the U.S. FDA (Food and Drug Administration) granted regulatory approval of Bavencio in combination with Inlyta (axitinib) as a first-line therapy in patients with advanced renal cell carcinoma (RCC).

Moreover, Healthcare is also aiming to develop highly promising active ingredient candidates from its R&D pipeline in a targeted manner, also in cooperation with strong partners. In June, Merck published updated results of a potentially registrational Phase II study for tepotinib. The data showed durable anti-tumor clinical activity for the investigational targeted therapy in a certain patient group (subtype METex14) in advanced non-small-cell lung cancer (NSCLC). On September 8, updated results for tepotinib were presented at the 2019 World Conference on Lung Cancer and patient enrollment in the Phase II INSIGHT 2 study of tepotinib in combination with the tyrosine kinase inhibitor (TKI) osimertinib began. Additionally, on September 10, Merck announced the start of two potentially pivotal Phase III studies for the investigation therapy evobrutinib in the indication relapsing multiple sclerosis. Back in February, the company had entered into an agreement with GlaxoSmithKline to co-develop and co-commercialize the immuno-oncology drug bintrafusp alfa. The agreement has a potential overall value of € 3.7 billion.

The core business with existing medicines is to form the basis for the sustainable growth of the Healthcare business sector. Merck is aiming for sales to at least remain stable; in the first half of 2019 they totaled € 2.6 billion. Above all, in its General Medicine & Endocrinology franchise, Merck sees considerably rising demand for medicines owing to the global rise in the incidence of cardiovascular diseases and diabetes. The General Medicine portfolio of Merck comprises medicines to treat these conditions, among others. For example, the diabetes medicine Glucophage is now approved in 50 countries for prediabetes when intensive lifestyle changes have failed. Merck is also expecting the Fertility franchise to generate further growth. In the first half of 2019, this franchise generated sales of € 601 million.

Life Science intends to maintain above-market growth trajectory

In the coming years, the Life Science business sector plans to deliver annual growth of 5% to 8% per year, thus continuing to outpace market growth. Life Science intends to defend its industry-leading profitability. The high-growth Process Solutions business unit and the e-commerce platform SigmaAlrich.com, which generates more than € 1.5 billion in sales, are expected to drive this growth.

Process Solutions supplies state-of-the-art process technology for use by biotech and pharmaceutical companies as well as important products for the development of cell and gene therapies. The portfolio is designed to support the manufacturing needs of both emerging biotech and large pharma companies. In addition, the business is benefiting from the growing number of biologic pipeline projects across the industry. The growth prospects rely not only on the increasing demand for monoclonal antibodies, but also on new treatment approaches such as gene and cell therapy. Merck meanwhile holds 20 CRISPR patents worldwide.

In recent years, Life Science has doubled its sales with new products and is continuously investing in highly promising new technologies such as the BioContinuum platform. With this, Life Science wants to significantly simplify and accelerate the complex manufacturing process for biotech medicines for its customers. Additionally, Life Science is giving high priority to the steady expansion of its network of production and service sites as well as customer centricity in Asia and North America.

Performance Materials expected to resume growth as of 2020

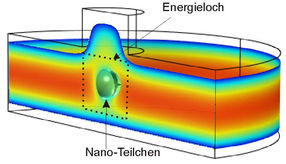

Performance Materials has made significant progress with the implementation of its “Bright Future” transformation program announced in summer 2018. As a leading solutions provider in the electronic materials business, Performance Materials aims to benefit from sustainable growth trends, particularly the trend towards increasingly higher data volumes worldwide. As of 2020, Merck assumes that average annual sales growth in Performance Materials will range between 2% and 3%. The long-term EBITDA pre margin target is around 30%. Merck continues to assume that the market for semiconductor materials, measured in terms of silicon wafer area shipments (MSI, million square inches), will return to growth as of 2020. The planned acquisitions of the U.S. companies Versum Materials for around US$ 6.5 billion and Intermolecular for around US$ 62 million are expected to close in the second half of 2019, subject to regulatory clearances and the satisfaction of other customary closing conditions. The integration planning process has already made excellent progress.

The OLED materials business is also showing a tremendous growth dynamic. According to industry estimates, the volume of the overall market for OLED materials will exceed that for liquid crystal materials as of 2022. In August, Merck and Universal Display Corporation (UDC) announced an R&D cooperation in the OLED field in order to accelerate the development of new products and further advance OLED technology. In 2016, a collaboration agreement was entered into with Idemitsu Kosan, likewise a well-established developer of OLED materials. In order to further strengthen its presence in the OLED materials market in Asia, Merck opened an OLED technology center in Shanghai in 2018 in addition to its existing centers in Southeast Asia. Merck wants to work as a local partner with customers to advance innovations and shorten time-to-market.