BASF Makes All-Cash Proposal To Acquire Engelhard

Advertisement

BASF Aktiengesellschaft has made an all-cash proposal to acquire all outstanding shares of common stock of Engelhard Corporation, supplier of goods for catalysis and surface finishing, for US$37.00 per share or an aggregate of US$4.9 billion. This price represents a 23% premium above the December 20, 2005 closing price of Engelhard's stock of US$30.05 and a 30% premium over Engelhard's 90-day average share price (VWAP) of US$28.42 as of December 20, 2005. This price also represents a premium to Engelhard's 2005 year-end closing price of US$30.15 and to the four-year-high closing price of US$32.49 achieved on July 14, 2004.

By acquiring Engelhard, BASF would become a leading provider worldwide in the dynamically growing catalyst market. "Engelhard is an excellent enhancement for the BASF portfolio," said Dr. Jürgen Hambrecht, Chairman of the Board of Executive Directors of BASF Aktiengesellschaft. "By combining the R&D activities of both companies, BASF would create a unique global technology platform for catalysts and open up further growth and innovation potential."

BASF has made efforts to negotiate a friendly transaction with Engelhard's Board of Directors and management. BASF has said that its team is prepared to meet with the Engelhard team to see whether Engelhard can demonstrate value in addition to that discernible from the publicly available information that might enable BASF to increase the price that it proposes to pay for Engelhard by US$1.00 per share. These efforts have been rebuffed.

Most read news

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

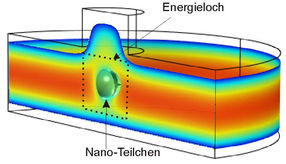

Scientists discover world's smallest superconductor - Study paves way for development of nanocircuits for energy, electronics applications

Smaller isn't always better: Catalyst simulations could lower fuel cell cost

Atofina: New acquisition by Cray Valley in Southeast Asia

Category:Pharmacy_organizations

BASF Raises Offer to Engelhard Shareholders to $39 Per Share - BASF CEO Hambrecht: "This is our last, best and final offer."

Philip Morris Stiftung - München, Germany