AkzoNobel announces intention to restructure and split ICI Pakistan

Advertisement

Akzo Nobel N.V. has announced its intention to seek agreement from the Board and shareholders of ICI Pakistan Limited to separate the organization's paints and chemicals businesses.

Under the terms of the proposal, AkzoNobel would retain direct majority control of the paints business by separating it into a new legal entity (AkzoNobel Pakistan Limited) through a de-merger process approved by the Pakistani courts. Subsequently, AkzoNobel would dispose of its entire shareholding in the remainder of ICI Pakistan.

The entire ICI Pakistan business has been a subsidiary of AkzoNobel since 2008, when the company acquired Imperial Chemical Industries PLC. It is listed on the Karachi, Lahore and Islamabad Stock Exchanges, with AkzoNobel currently holding 75.8 percent of the total shares. Focusing primarily on the Pakistan market, ICI Pakistan's main businesses are polyester fiber, soda ash, life sciences, chemicals and decorative paints. In 2010, ICI Pakistan's revenue amounted to €305 million.

During the last few months, AkzoNobel has been conducting a strategic review of the businesses and it became evident that ICI Pakistan's paints business would be of clear commercial benefit for the company. Although the remainder of the ICI Pakistan portfolio is made up of strong and promising businesses, they do not offer sufficient opportunity to create value within AkzoNobel's transformed portfolio and future strategic ambitions.

AkzoNobel believes that in order to provide the best growth opportunities for the activities carried out by ICI Pakistan (apart from paints), it would be most beneficial for all concerned if the company was transferred to a new owner who could commit to investing and help to realize its full potential. Accordingly, AkzoNobel's intention would be to seek a new owner for its shareholding in ICI Pakistan through a formal sale process once the paints business is separated.

The procedure for achieving this strategic change would involve a two-stage process. Initially, two companies would be created through a de-merger process approved by the shareholders of ICI Pakistan and sanctioned by the Pakistani courts. Both would be listed and AkzoNobel would own 75.8 percent of each. The business, assets and liabilities of the paint business would be called AkzoNobel Pakistan Limited. ICI Pakistan would comprise all of the remaining businesses, assets and liabilities.

Once the de-merger is completed, AkzoNobel would undertake the formal process of identifying an appropriate buyer for its shareholding in ICI Pakistan.

Most read news

Other news from the department business & finance

Get the chemical industry in your inbox

By submitting this form you agree that LUMITOS AG will send you the newsletter(s) selected above by email. Your data will not be passed on to third parties. Your data will be stored and processed in accordance with our data protection regulations. LUMITOS may contact you by email for the purpose of advertising or market and opinion surveys. You can revoke your consent at any time without giving reasons to LUMITOS AG, Ernst-Augustin-Str. 2, 12489 Berlin, Germany or by e-mail at revoke@lumitos.com with effect for the future. In addition, each email contains a link to unsubscribe from the corresponding newsletter.

Most read news

More news from our other portals

Last viewed contents

'Poisoning' corrosion brings stainless magnesium closer

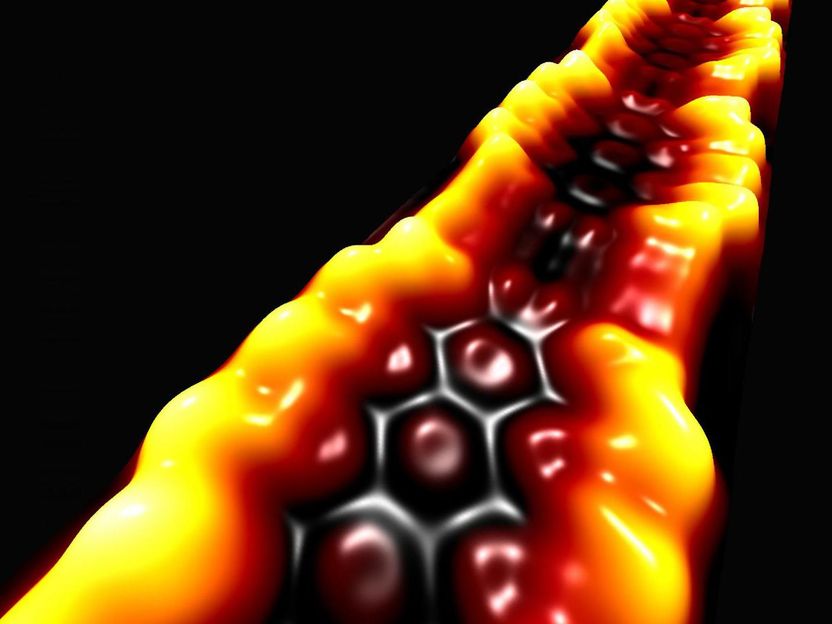

Tying down electrons with nanoribbons - 'Topological' graphene nanoribbons trap electrons for new quantum materials